HEALTH INSURANCE

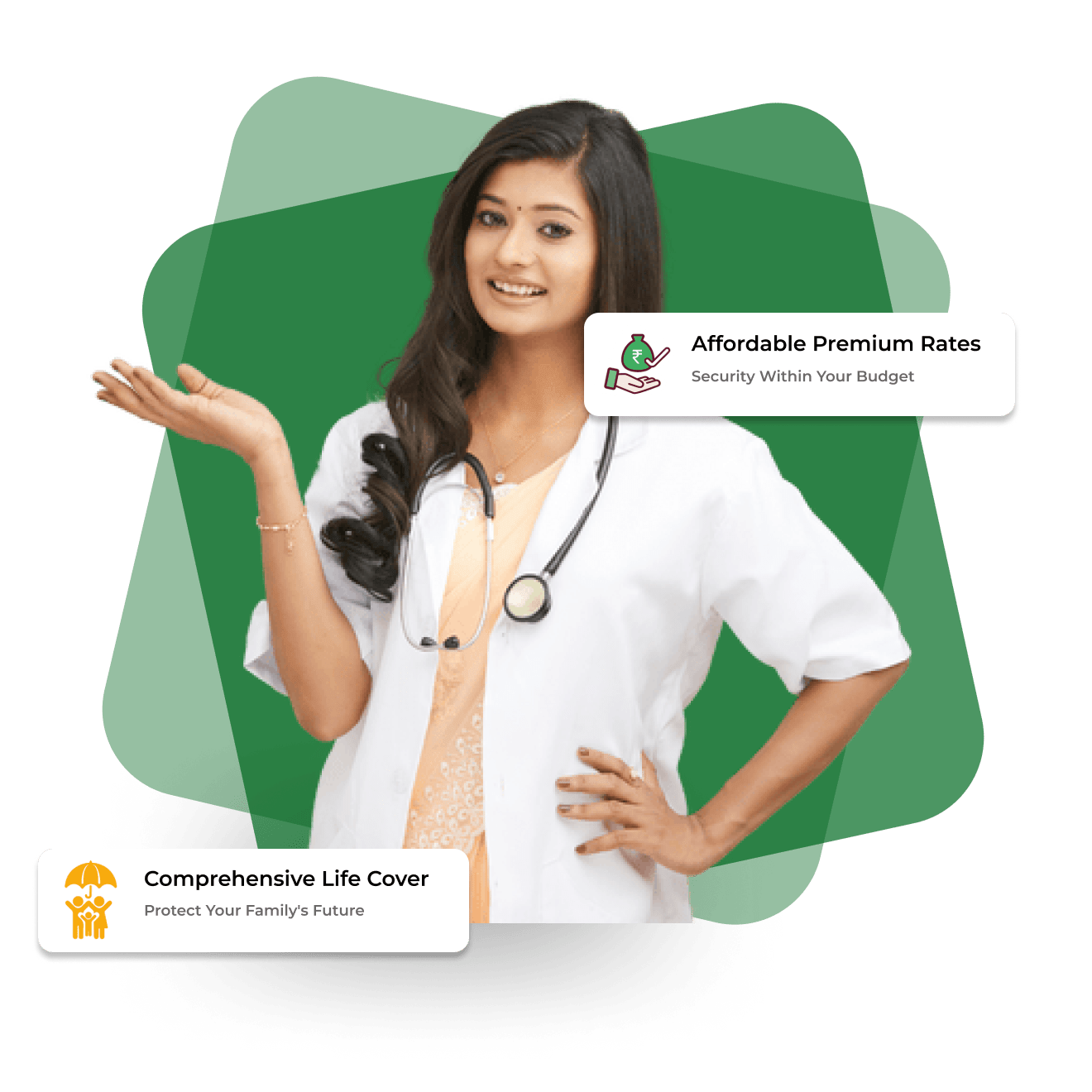

Get the Best Health Insurance Plans with Finwelco

Shedule a FREE Home visit with

our expert advisors

Health Insurance

Finwelco helps you choose the best life insurance plan by partnering with top providers. We offer tailored solutions with affordable premiums and comprehensive coverage to secure your family’s financial future. from managing daily expenses to education and healthcare, we guide you in selecting a plan that ensures peace of mind for your loved ones.

BENIFITS

Health Insurance with Finwelco

How we process your health insurance plan in just 30 minutes to 6 hours!

Protect your health in 3 simple steps with a quick, seamless, and customer-focused process!

basic Details

visits you

How’s Finwelco different?

FAQ

Frequently asked questions

What is health insurance?

Health insurance is a type of coverage that pays for medical and surgical expenses incurred by the insured. It covers hospitalization, treatment, doctor consultations, surgery costs, and other healthcare-related expenses, depending on the policy.

Why should I buy health insurance?

Health insurance helps protect you financially in case of illness or accidents. It ensures that you have access to necessary medical treatment without worrying about high healthcare costs. Health insurance also provides preventive care, making healthcare more affordable.

What does health insurance cover?

Health insurance coverage typically includes:

● Hospitalization costs : Room charges, doctor’s fees, surgeries, etc.

● Pre and post-hospitalization expenses : Medical tests, treatments before and after hospitalization.

● Ambulance fees : Emergency transport to the hospital.

● Daycare procedures : Surgeries that don’t require overnight stays.

● Health check-ups : Preventive health exams, vaccinations, etc.

How does health insurance work?

Health insurance works by paying regular premiums to an insurance provider. When you require medical treatment, the insurance company pays a portion or all of the medical bills, depending on your plan and policy terms. The cost-sharing can be in the form of co-pays, deductibles, or co-insurance.

What types of health insurance policies are available?

The major types of health insurance policies include:

● Individual Health Insurance : Covers only one person, ideal for those who need coverage for themselves.

● Family Floater Plan : Covers only one person, ideal for those who need coverage for themselves.

● Critical Illness Insurance : Covers expenses related to serious health conditions like cancer, heart attack, etc.

● Maternity Insurance : Covers expenses related to pregnancy, delivery, and newborn care.

● Top-Up Plans : Additional coverage above your existing health insurance policy.

How do I choose the best health insurance plan?

When choosing a health insurance plan, consider:

● Coverage options : Ensure the policy covers essential treatments, procedures, and emergencies.

● Premiums and co-pays : Balance affordable premiums with the coverage provided.

● Network hospitals : Check if the insurer has tie-ups with a wide range of hospitals for cashless treatments.

● Claim process : Look for insurers with a straightforward and quick claims process.

● Waiting period : Understand the waiting periods for specific illnesses or pre-existing conditions.

What is the waiting period in health insurance?

The waiting period in health insurance is the time you must wait before certain conditions or treatments are covered. It typically applies to pre-existing diseases, maternity, or specific treatments like cataract surgery. The waiting period can range from 30 days to 4 years, depending on the policy.

Can I get health insurance if I have a pre-existing condition?

Yes, you can get health insurance if you have a pre-existing condition. However, the insurer may impose a waiting period before covering expenses related to that condition. The waiting period varies by insurer and policy.

What is a cashless treatment in health insurance?

Cashless treatment allows you to avail of medical treatment without paying upfront. The insurance company directly settles the bill with the hospital (within the network of the insurer). You only need to pay for non-covered expenses.

How can I reduce my health insurance premiums?

You can reduce your health insurance premiums by:

● Opting for a higher deductible or co-pay.

● Choosing a family floater plan instead of individual plans.

● Maintaining a healthy lifestyle (no smoking, regular exercise).

● Opting for a plan with fewer add-ons and riders.

● Comparing different policies before purchasing.

Can I claim health insurance for preventive treatments?

Yes, some health insurance policies offer coverage for preventive care like annual health check-ups, vaccinations, and screenings. These are often available as part of wellness benefits or as an add-on.

Testimonial

Our Clients Say!

Ritika Sharma

Jaipur

Finwelco ensured my family's future is secure! The Term Insurance process was smooth, the documentation was minimal, and the policy terms fit perfectly into my long-term goals. Highly recommend their services!

Amit Verma

Delhi

During a recent medical emergency, Finwelco's Health Insurance came through with a seamless cashless process. They truly prioritize their customers' well-being in times of crisis. Thank you for the support!

Satish Chandra

Uttar Pradesh

The team at Finwelco is amazing! From comparing different plans to receiving the policy kit, the entire digital process was incredibly fast. Best insurance advisory service I’ve ever experienced.

Rahul Gupta

Bangalore

Finwelco’s life insurance plans helped me create a solid financial safety net for my business and family. Their premium rates are very competitive, and the team guides you through every small clause.

Priya Nair

Hyderabad

I was skeptical about choosing the right insurance online, but Finwelco made it so simple! They are transparent, professional, and provided the expert advice I needed for my retirement planning.